Some drivers being in their lane looking only at the automobile straight in front of them, blind to everything else. This makes no sense. But neither does the method of darting in and out, continuously changing lanes, honking, attempting to think which lane is best. This strategy just increases the opportunities of getting into an accident, reduces mpg and increases the stress of getting to where you wish to be.

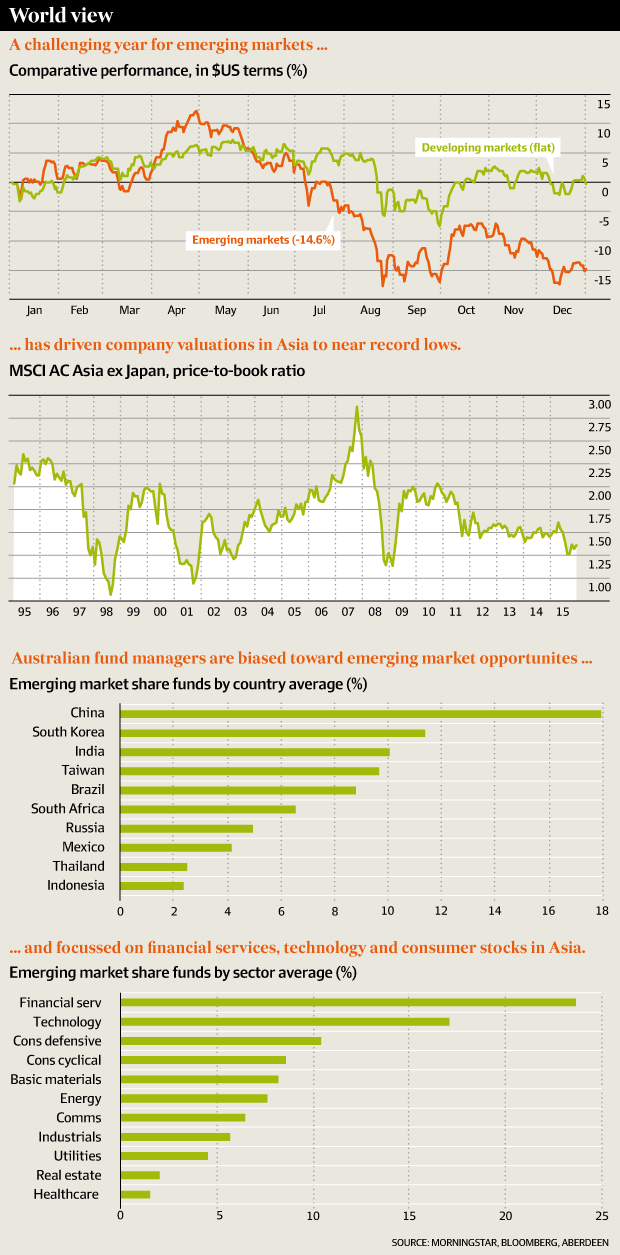

What do you see? Out of the 10s of countless stocks, sectors, ETFs, shared funds, closed-end funds and bonds the leading entertainers of 2010 all came from 3 sectors. Innovation. Commodities. Emerging Markets Technology is at the top of the list because it helps companies cut expenses and be more lucrative. Because of the world's central banks printing trillions of dollars/Yen/Euros/ etc, commodities made the list. And lastly we have Emerging Markets, which maybe is a misnomer. Is Singapore, Taiwan, Hong Kong and China actually emerging. I believe they have actually emerged.

Use the ED scripts to remember. Place them in this section. Keep in mind all referrals. On the divider itself, have a list of the EDs and note when you last talked with them. Stay connected with them. They'll assist you when you get to town.

Always try to find the dividend payers. They beat the non-dividend payers each emerging markets entails time. According to a research done by the Ned Davis research study company, firms in the S & P that raised dividends acquired approximately 8.8% each year in between 1972 and 2010, contrary to those that cut dividends or even worse yet, that never paid them.

The iron ore debacle, for instance, was probably an outcome of speculative excess at the local level. Many traders scratched their heads on hearing the news of 90 large iron ore trucks idling in the water for 2 weeks or more, waiting to dump at overruning Chinese ports.

If you could only have one investment, a lot of people in the financial services industry would choose VT, but they wouldn't tell you. Their income is frequently depending on producing an aura of mystique, of being a professional, of knowing something no one else does. Essentially what they promote at work isn't necessarily the same thing they do with their own investment portfolios.

So, while you dump your apparently safe US Treasuries - buy the AllianceBernstein Global High Yield (NYSE: AWF). Purchase the Templeton Emerging Markets (NYSE: TEI). Buy the Western Possessions Emerging Markets (NYSE: EFL). Collectively these three alone are creating yields right now of almost 9 percent while continuing to carry out with a year to date average return of 31 percent which is a yearly rate of return of nearly 100 percent.